Gain access to a curated investment platform coupled with automated monitoring, efficient trading, and tax-aware rebalancing.

Maximize efficiency and minimize friction with paperless account opening, transfers, reoccurring distributions, billing, performance reporting, and compliance support.

Deliver clarity and actionable insights through a seamless investing dashboard

Access practical, field-tested growth solutions through our exclusive Growth Dividend System™

At the Model FA, our purpose is to help entrepreneurial financial advisors build thriving, successful practices. We believe that traditional TAMP and investment management platforms don’t go far enough to position financial advisors for growth.

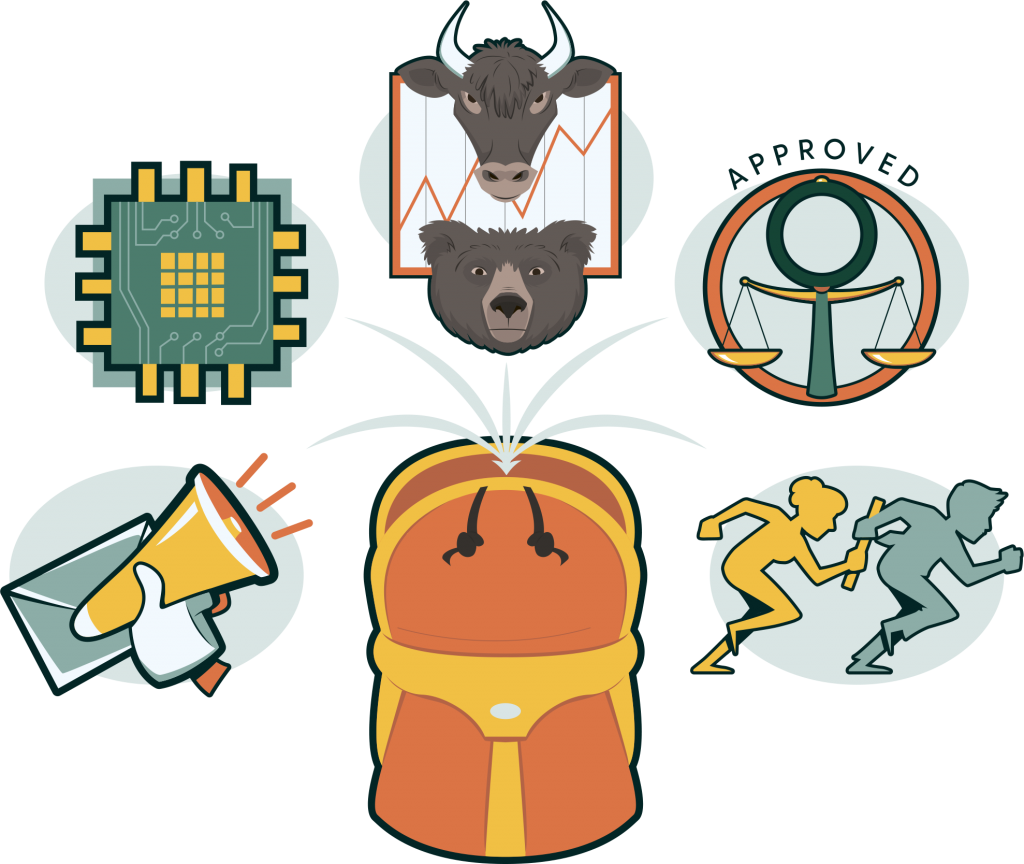

Model Folios combines everything an advisor would expect from a modern TAMP (robust investment models, tax-efficient rebalancing, automated trading, comprehensive reporting, seamless dashboards, etc.) — and augments it with tactical, practical marketing solutions that power advisor growth.

Tap into our proprietary marketing and practice management system that allows entrepreneurial financial advisors to predictably grow their practices while solving the capacity issues that are inevitable during periods of accelerated growth.

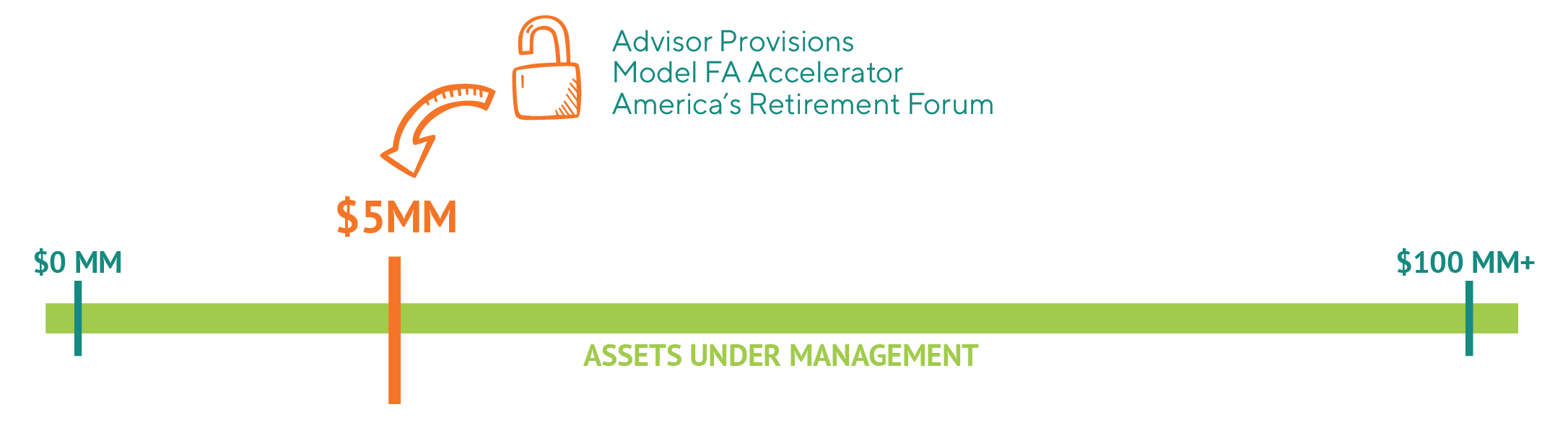

Once asset levels reach $5MM, advisors on the Model Folios platform unlock access to our proprietary practice management technology, fully-managed digital marketing campaigns, marketing collateral, and one-on-one coaching powered by the Model FA Accelerator. Explore each solution in the sections below.

A comprehensive, flexible practice management system that empowers advisors to deliver exceptional, referral-worthy client service on autopilot.

A turnkey retirement seminar and webinar system that connects a national non-profit educational organization with advisor instructors. ARF uses a low-cost combination of digital marketing, live educational events, automated online workshops, and curated follow-up content to build awareness and showcase advisor expertise. Advisors around the country are using this system to add millions in assets to their practice each month.

A performance coaching and practice development program designed to help financial advisors grow through accountability and proven marketing strategies. Includes individual coaching calls, access to 24 live group coaching calls per month, and dozens of self-paced educational modules in the digital learning center.

A professionally designed, SEO-optimized website template to update the advisor’s brand, elevate their online presence, and help them reach more prospects. Copywriting and coaching support to align the new website with the advisor’s unique value proposition and ideal clients.

Access the investments you need to help your clients reach their goals. The Model Folios platform delivers a comprehensive list of sophisticated, evidence-based investment portfolios from vetted third-party strategists that enable you to support your entire book of business.*

Our Factor-Based models are steeped in decades of empirical research, analysis, and practical insight from leading academics and pioneers in the field of modern finance. The result is a low cost, broadly diversified portfolio that overweights certain characteristics, or factors, to seek higher expected returns — executed through an efficient, cost-conscious, and repeatable process. These models are appropriate for investors who wish to embrace financial science and prioritize expected returns, as opposed to tracking an index.

Like our Factor-Based investment strategies, these portfolios hold nearly 12,000 securities from over 40 countries. Fees are a bit lower, and tax efficiency is considered to a greater degree. The underlying asset class strategies in the Index & ETF models are designed to track specific indices and to deliver market rates of return, rather than tilting towards small cap, value and more profitable stocks (factors) to try to beat the market. These investment strategies are appropriate for investors who frequently compare portfolio performance to benchmarks such as the S&P 500, and who may be wary of short-term deviations from commercial indices.

The Enhanced Return models leverage rules-based methodologies to manage risk and seek enhanced portfolio returns. These strategies are engineered to stay invested in growing or sideways markets, and to get defensive in severe corrections or bear markets, striking a balance between growth and downside protection. These models may be appropriate for investors who are looking to reduce portfolio volatility and are seeking better risk-adjusted returns.

The Downside Protection models apply a quantitative, rules-based approach designed to reduce risk and limit the loss of wealth during market downturns. These tactical strategies utilize fundamental and technical analysis and apply a dynamic portfolio construction methodology to seek a reduction in volatility and potentially improve risk-adjusted returns.

The Socially Responsible models pursue competitive returns while delivering positive social outcomes, allowing investors to align their investment portfolio with their values and beliefs. This investment strategy starts with a broad universe of global stocks and bonds and then underweights or overweights companies largely based on their ability to meet certain socially-responsible screens. Considerations include alcohol, tobacco, firearms, and weapons of mass destruction, among other factors.

The Sustainability models enable investors to pursue their environmental goals within a highly diversified and efficient investment strategy. These portfolios emphasize investment in companies that act in more environmentally responsible ways. Considerations include carbon and other greenhouse emissions, or potential emissions from reserves, land use, cluster munitions manufacturing, biodiversity, involvement in toxic spills or releases, operational waste, water use, child labor, and factory farming activities, among other factors.

Model Folios services include investment proposal generation, investment portfolio construction, account management, full back office support (including digital client onboarding and servicing, account setup and transfer, account administration, trading, reporting, and billing), and a robust online client portal.

REQUEST A DEMOThe primary purpose of the Model Folios Investment Committee is to drive discipline and consistency through the portfolio-management function. Our team applies years of technical investment and financial planning experience to maintain a rigorous investment selection and monitoring process.

Patrick Brewer, CFA, CPA

Founder & Chief Investment Officer

Jeff Brewer, CFP®

Jason Mirabella