Financial Planning Workflows and Technology: Case Studies

08.06.19 | Jason Mirabella | 0 Scale

Financial planning workflows and processes get a bad rep.

When advisors think about creating a world-class client experience, their minds usually go straight to technology. How can I automate this step? How can I use integrations to make these two systems talk to each other? With dozens of FinTech solutions in the market, one can easily spend weeks or even months demo-ing new features and building the most cutting-edge tech stack ever.

And that would be a mistake.

It’s true that technology is an important part of running a modern financial advisory firm. However, advisors who put technology first will discover that tinkering with settings and APIs will fill up their time — but it won’t produce a comprehensive vision for what it’s like to be a client (or what it’s like to work at the firm).

When I think about building a client experience, I see three distinct sets of decisions to be made. Most advisors rush through the first one… and completely miss the third one. Here is a blueprint you can use to check and optimize your own approach.

Step 1: Define your advisory service offer.

You must begin by diving deep into your service offer. As Dominique Henderson has mentioned in an earlier article, it’s important to start with your target clients. Are you targeting entrepreneurs, millionaire next door executives, doctors, pre-retirees, retirees? What are their pain points? What do they consider valuable? What specific deliverables and touch points would make them feel like they are getting world-class client service?

These are hard questions, which is why many advisors rush through this part of the process and just assign A, B, and C client designations based on AUM. AUM-based client segmentation is convenient and quick, but it’s not meant to build life-long connections or inspire raving fans.

The other reason why it’s important to define your service offering is because it will drive your profitability. Every client service experience has a price tag. You must know exactly what it’s going to cost you and your team, both in terms of money and time. If you plan to deliver the exact same experience to your million-dollar clients as you do to your $250K clients, you are likely to underwhelm the first group and overwhelm the second.

There’s wisdom in setting and enforcing minimums at the AUM or revenue level. There’s also wisdom in building different service offers based on client category. So, you might have a full-service wealth management offer for your million-dollar plus clients, along with a lighter, investment centric offer for those with $250K in assets.

After you define the value you are planning to deliver, the next step is to translate it into specific actions — both on the front end (i.e. client-facing) and the back end. What exactly are you going to do for those clients, and when?

See also: Building a Financial Advisor Value Proposition that Someone Will Buy

Once you have clarity on service milestones and timelines, it’s time to turn to technology.

Step 2: Wrap technology around your offer

Technology is fun. There are so many options, all shiny and new, all promising unprecedented efficiency in an impressive package. Unfortunately, many advisors fall into the trap of putting their focus on technology at the expense of (1) carefully defining client service in human terms, and (2) setting up human communication and accountability systems.

In other words, financial planning workflows.

At SurePath Wealth, we liked the idea of a technology-facilitated client service calendar. Many advisors rely on their CRM as the master record of client touch points, and they keep their service calendar there. The problem with that approach is that it doesn’t lend itself to calendarizing or accountability.

We decided to take a different route.

At its heart, execution of client service is a project management challenge. So, we opted to use specialized project management software to solve this puzzle. This may be a bit unconventional, but it has worked really well for us. In fact, I credit a lot of our growth in the early years to this single decision.

How did we do it? I will get to two specific case studies that illustrate examples of proactive and reactive financial planning workflows below. For now, here are three best practices for advisors who want to optimize their workflows and technology.

- When you get fancy, fancy gets broken. Start out as simple as you can. Add complexity only after you see specific and real need for it. Make sure that every feature serves a real purpose and adds value. Many advisors over-engineer their workflows and wonder why their team ignores operating procedures and doesn’t want to learn the next tech.

- Be mindful of automating the wrong thing. Specifically, resist the temptation to automate the client-facing portion of the service experience. Patrick Brewer has more on that in a separate article, so I will just offer a summary here. The reason to add automation to your business is to streamline and add efficiency on the back end — so that you can have the resources to customize and deliver a high-touch client-facing experience.

- Be careful with integrations and APIs. They seem like the silver bullet answer to sharing data across systems, and they can be quite effective… when they work right. Unfortunately, putting an integration in place and assuming you are done is a recipe for a problem. You must remember that every point of automation and every non-native API is a potential weak link. Make sure that you set up proper monitoring and develop a Plan B in the event that an integration or an API fails.

And before we get to the case studies, there is one last best practice point to share.

Step 3: Set up accountability and communications

Delivering client service in a financial advisory firm is a complex and highly dynamic endeavor. It takes collaboration between multiple professionals, which is difficult to achieve without a formal system for communication and accountability. Every single point of client service must get translated into an action. That action must be scheduled and assigned to a specific person, with clear expectations about timing, quality standards, and supervisory responsibilities.

Of course, you must do all of this in a way that scales with the growth of your firm. Without standardization, you will be spending too much time re-inventing the wheel. Many advisors don’t realize that the quality of these accountability and communication systems is a key driver of client experience, firm culture, and work-life balance for those working at the firm. Your goal in setting up accountability and communication systems should be to make every single person at your firm replaceable, including the owners.

In the case of SurePath, we accomplished that goal by combining our project management software called Monday with a communications tool called Slack. More on Slack in a future post! My focus today is to show you how we build our financial planning workflows using Monday.

Case Study: Reactive Financial Planning Workflows

We define reactive client service requests as anything that is originated outside of the firm.

Think of common inbound inquiries or requests you might get from a client, like a question about the portfolio, or a withdrawal request. Any advisory office receives multiple inbound requests on a daily basis, so everyone needs a system for blocking and tackling them in a way that’s reliable and predictable.

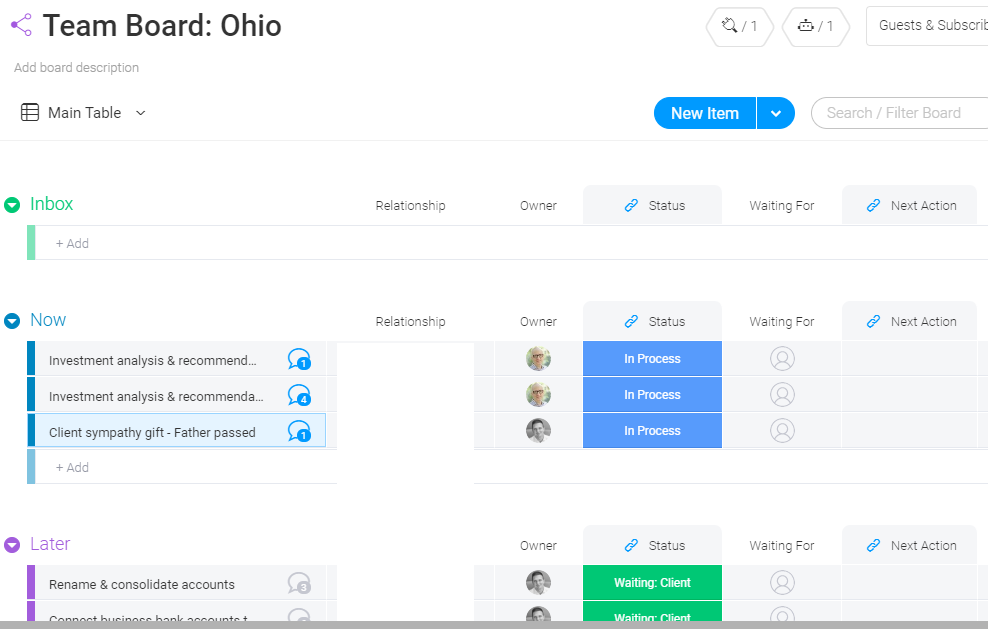

Here is a screenshot of our workflow management system called Monday. If you have never seen Monday before, all you need to know is that it is set up using “boards” for grouping projects and actions.

You are seeing the board (i.e. view) for Columbus, OH, one of our firm’s locations. There is a separate reactive board for every location, as this is a key dashboard that our team references multiple times throughout the day.

At the left of the screen, you see all the boards a team member has access to. Access privileges are easily customized, so that all team members have the tools they need without being overwhelmed.

In the main part of the board, you see that all reactive service requests are grouped into “Now”, “Later”, and “Projects”. This setup allows us to prioritize our efforts. Every action on the board shows an updated status: waiting on the client, follow up, done, etc. If you are trying this on for size, be sure to note that it’s important to define what each status means to avoid misunderstandings.

You will notice that every action has an owner – or one professional who is accountable for taking that action. Monday also allows you to assign secondary stakeholders who may wish to supervise or monitor progress.

Finally, there are clear deadlines.

The “Projects” section contains multi-step action sequences that we are working on. Examples include compliance program follow-up, status updates for investment management tasks, portfolio audits, etc. Same rules apply: there is one owner, deadlines, and clarity on next action.

Everyone at the firm can be added to the board to easily identify what must be done and who is doing it. This is helpful for people responsible for taking those actions, as well as for our management team. Any time there is a delay, a problem, or a miscommunication, Monday boards allow us to get to the bottom of the issue and resolve it quickly.

Case Study: Proactive Financial Planning Workflows

In contrast, proactive client service is anything that’s originated from inside the firm. New client onboarding is a great example of a proactive client flow.

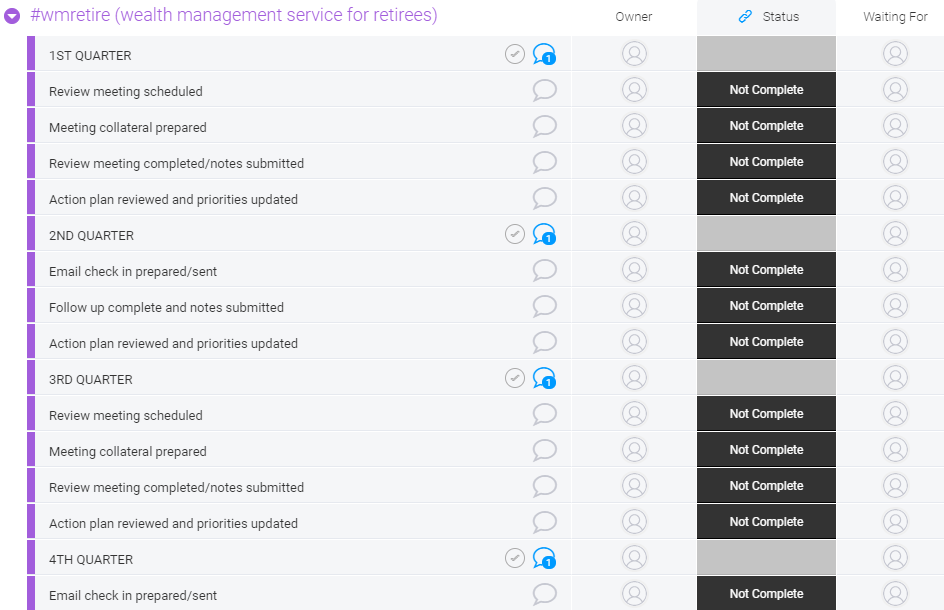

At SurePath Wealth, every new client gets his or her own Monday board. Each board reflects the specific service offering that client has signed up for. So, a Monday board for a new pre-retiree client will look different from a Monday board we create for a business owner.

One of our favorite things about Monday is that it supports a good balance between scale and customization. Our service offerings are standardized. Some of the examples include “initial financial plan”, “wealth management service for accumulators”, or “investment centric offer for retirees with under $500K”.

Every service offering is translated into a set of actions or a template on a Monday board. So, under “wealth management service for accumulators”, you might see something like this for the 1st quarter: review meeting scheduled, review meeting completed/notes submitted, financial plan updated, action plan reviewed and priorities updated, prior year investment performance reviewed, employer-sponsored plan reviewed and rebalanced, prior and current year IRA contributions scheduled.

Finally, every new client gets a “client concierge” who is ultimately responsible for onboarding that client. This could an advisor, an assistant, or someone else at the firm.

Because our service workflows are standardized, we get the benefit of accumulating and re-purposing collateral. From email templates to meeting agendas, our team can fall back on materials that they can update in just minutes.

Another thing worth highlighting is our use of tags.

Our tags are directly connected to service offers, so an example might include “#wmacc” for “wealth management service for accumulators”. There are household-level tags that define things like service level, and also individual-level tags for things like account custodian or whether the client has a Roth conversion. We use the same set of pre-defined tags across Monday and our CRM system (called Copper), which creates nice continuity between the tools. It allows us to deliver seamless client service — and create complete and accurate records inside the CRM with no extra effort.

Combining financial planning workflows and technology: The SurePath way

There are pros and cons to any workflow setup, and there is certainly no “one size fits all” way to solve this puzzle for every firm.

However, using a specialized project management software to coordinate the delivery of client service has been very successful for us at SurePath Wealth. Monday allows us to quickly train a new advisor or a member of our support staff. Everyone at the firm understands our methodology, knows exactly what they are accountable for, and has a framework to prioritize their work. If there is a breakdown or an obstacle, we can identify it and resolve it immediately.

And yes, using Monday has made everyone at our firm replaceable, even the owners. It has allowed us to attract and retain professional talent, set quality standards, define career growth trajectories, and improve quality of life for both employees and owners. Over the source of several years, we have created a dynamic system for financial advisor workflow management that has an elegant clarity and simplicity to it.

Of course, it goes deeper than any article could possibly cover, so if you have any questions about financial advisor workflows — ask away!